nasutki39.ru

Learn

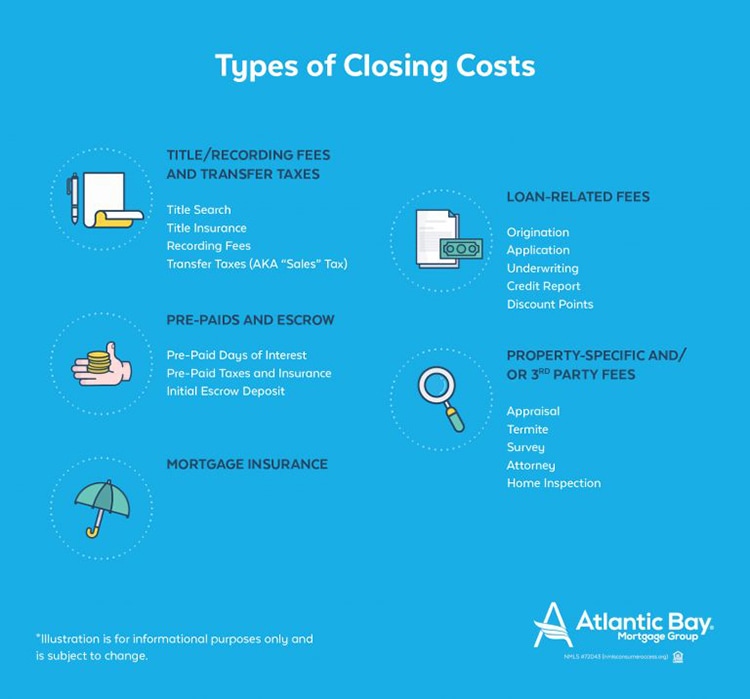

What Covers Closing Costs

How do you calculate closing costs? It's relatively simple to calculate closing costs. · Land transfer taxes · Legal fees · Home appraisal fee · Moving costs · Home. In short, yes. Rolling closing costs into the mortgage means increasing the principal balance of your loan to pay off those extra expenses. Home-buying closing costs can include attorney fees, property appraisals, and mortgage fees. Sometimes these are fixed costs, and other times they're negotiable. FHA and USDA loans allow the seller to contribute up to 6% of the sales price toward closing costs, prepaid expenses, discount points, etc. The funds from the. Who Pays Closing Costs In GA? · Real Estate Agent Commissions · Title Transfer Tax or Warranty Deed · Owners Title Insurance · Attorney Fees · HOA Transfer Fees. Closing costs must be paid in full by the buyer to compensate the realtors involved for funding, insuring and approving the property's sale. Home buyers usually pay between about 2% to 5% of the purchase price of their home in closing costs. So, if your home costs $,, you might pay between. It covers the realtor fees of the seller agent and the buyer agent as well. Agent fee on average ranges from 3%~5% of the home selling price including 2%~%. Both buyers and sellers may share responsibility for closing costs, although buyers generally cover most expenses. Sellers typically handle real estate. How do you calculate closing costs? It's relatively simple to calculate closing costs. · Land transfer taxes · Legal fees · Home appraisal fee · Moving costs · Home. In short, yes. Rolling closing costs into the mortgage means increasing the principal balance of your loan to pay off those extra expenses. Home-buying closing costs can include attorney fees, property appraisals, and mortgage fees. Sometimes these are fixed costs, and other times they're negotiable. FHA and USDA loans allow the seller to contribute up to 6% of the sales price toward closing costs, prepaid expenses, discount points, etc. The funds from the. Who Pays Closing Costs In GA? · Real Estate Agent Commissions · Title Transfer Tax or Warranty Deed · Owners Title Insurance · Attorney Fees · HOA Transfer Fees. Closing costs must be paid in full by the buyer to compensate the realtors involved for funding, insuring and approving the property's sale. Home buyers usually pay between about 2% to 5% of the purchase price of their home in closing costs. So, if your home costs $,, you might pay between. It covers the realtor fees of the seller agent and the buyer agent as well. Agent fee on average ranges from 3%~5% of the home selling price including 2%~%. Both buyers and sellers may share responsibility for closing costs, although buyers generally cover most expenses. Sellers typically handle real estate.

Who Pays Closing Costs In GA? · Real Estate Agent Commissions · Title Transfer Tax or Warranty Deed · Owners Title Insurance · Attorney Fees · HOA Transfer Fees. The seller typically pays closing costs from the sale proceeds. Significant expenses include: Realtor fees and brokerage commission; State deed tax and mortgage. What You Need to Know · Appraisal: A third party fee for having a certified appraiser determine the market value of the subject property · Origination Fee: A fee. Application Fee: This fee covers the cost for the lender to process your application. · Appraisal: · Attorney Fee: · Closing Fee or Escrow Fee: · Courier Fee. They encompass various fees such as loan origination, underwriting, real estate agent commissions, home appraisal, title searches, closing attorney fees. Closing Costs in NYC range from % to 6% for buyers and 8% to 10% for sellers. NYC closing costs vary depending on property type, price and financing. These costs can sneak up on you — know what they are. Closing costs can run from 1% to 4% of your home purchase price — and they're are on top of your down. Property taxes, homeowners' insurance, and mortgage insurance premiums are prepaid closing costs. With no-closing-cost mortgages, the lender rolls the. Closing costs must be paid in full by the buyer to compensate the realtors involved for funding, insuring and approving the property's sale. Closing costs usually range from 2% to 5% of the price of your mortgage loan amount. For example, if you buy a $, home with 10 percent down ($10,) and. If closing costs are higher than you expected, you might be able to dip into the down payment to cover the costs. But, decreasing your down payment will. Closing costs include all legal, administrative and real estate related expenses you'll be responsible for paying in order to finalize the purchase or sale of. While there are rare exceptions where sellers are motivated to cover closing costs, most buyers should be prepared to pay buyer closing costs in their entirety. How much are closing costs? According to CNN, homebuyers can generally expect closing costs to range from 2% to 6% of the loan amount FootnoteOpens overlay. However, closing costs for first-time homebuyers can be greatly reduced by government rebates and exemptions. What is included in closing costs? How much. Closing Costs Explained · Origination: The fee the lender and any mortgage broker charges the borrower for making the mortgage loan. · Points: Points are a. Closing costs are fees you pay when you close escrow on a house, such as mortgage insurance premiums, appraisal fees, and property taxes. Most of the closing costs are covered by you, the buyer. For a rough Loan origination fee: This fee covers any administrative costs associated with processing. While there are rare exceptions where sellers are motivated to cover closing costs, most buyers should be prepared to pay buyer closing costs in their entirety.

Best Solar Technology Companies

The Leading solar panels overall · Panasonic, LG, and SunPower are among the top premium panel manufacturers. · Canadian Solar and Trina Solar are two of the best. Browse and compare solar panels from top manufacturers on the EnergySage Buyer's Guide. To learn about other solar energy system components. Top 24 Solar Energy Companies in the US · 1. Tesla · 2. SolarCity · 3. Sunrun · 4. First Solar · 5. Enphase Energy · 6. Blue Raven Solar · 7. Sungevity · 8. This is a list of notable photovoltaics (PV) companies. Monocrystalline solar cell. Grid-connected solar photovoltaics (PV) is the fastest growing energy. In , Qcells, Canadian Solar, and Maxeon/SunPower took the top three spots, but any panels on the list are great picks for your solar power system. Solar. SETO resources can help you figure out what's best for you when it comes to going solar. Consider these questions. Solar Power World, the leading solar publication covering technology, development and installation, publishes the Top Solar Contractors List annually. SEDG. SolarEdge Technologies. ; ENPH. Enphase Energy. ; RUN. Sunrun. ; FSLR. First Solar. ; DQ. Daqo New Energy. Why you can trust SolarReviews. SolarReviews is the leading American website for solar panel reviews and solar panel installation companies. Our industry. The Leading solar panels overall · Panasonic, LG, and SunPower are among the top premium panel manufacturers. · Canadian Solar and Trina Solar are two of the best. Browse and compare solar panels from top manufacturers on the EnergySage Buyer's Guide. To learn about other solar energy system components. Top 24 Solar Energy Companies in the US · 1. Tesla · 2. SolarCity · 3. Sunrun · 4. First Solar · 5. Enphase Energy · 6. Blue Raven Solar · 7. Sungevity · 8. This is a list of notable photovoltaics (PV) companies. Monocrystalline solar cell. Grid-connected solar photovoltaics (PV) is the fastest growing energy. In , Qcells, Canadian Solar, and Maxeon/SunPower took the top three spots, but any panels on the list are great picks for your solar power system. Solar. SETO resources can help you figure out what's best for you when it comes to going solar. Consider these questions. Solar Power World, the leading solar publication covering technology, development and installation, publishes the Top Solar Contractors List annually. SEDG. SolarEdge Technologies. ; ENPH. Enphase Energy. ; RUN. Sunrun. ; FSLR. First Solar. ; DQ. Daqo New Energy. Why you can trust SolarReviews. SolarReviews is the leading American website for solar panel reviews and solar panel installation companies. Our industry.

Embrace a brighter future with Kasselman Solar, a trusted leader in solar energy for over 10 years. With more than 75 years of combined industry expertise, we'. While many excellent solar companies are in the market, one reputable national agency that stands out is Smart Energy USA. Green Solar Technologies is a pioneer in the solar energy revolution. We provide only the highest-quality, American-made solar energy products to our valued. Go solar with SunPower, the top-rated solar company in the U.S. and America's provider of high-quality, reliable home solar and renewable-energy solutions. Trinity and Elevation top our list for their services and Sunrun rounds it out with its leasing options. Our guide explores the best solar companies. Sunrun is the leading home solar panel and battery storage company. Go solar for little to $0 down, lock in low energy rates. Get a quote today. Producing your own clean energy is a great alternative for anyone who values independence and efficiency, and Firefly Solar is one of the best companies who can. Top 50 Solar Energy Companies ; Horizon Solar Power, Temecula, CA ; JA Solar, China ; Kyocera, Japan. Sonnedix Solar is a global power company focused to generating future low-carbon solar energy. Details of the startup: You can find their website here. . 8). Top-of-the-Line Solar Panel Equipment. Dominion Energy Solutions customers deserve the best solar experience, so we offer only one level of quality: the best. Best Solar Companies · 1, Companies | 41, Real Customer Reviews · Sunnova · Gimenergy · Sunrun · ION Solar · Shinnova Solar · Empower Energy Solutions · Solar. Of all of the panel models from the manufacturers mentioned above, there are two that stand out for providing outstanding performance and overall value. These. Top 10 Best Solar Companies in Washington, DC - September - Yelp - Solar Solution, Revolution Solar, City Renewables, Jeremiah Solar Solutions. From design and installation through permits, approvals, rebates and financing, Sun First Solar handles Bay Area solar projects from start to finish. Sun First. Historical rankings · MW First Solar · MW Suntech solar · MW Sharp · MW HELIOSPHERA · MW Sungen Solar · MW Trony · MW Moser Baer. This list has the Bay Area's top solar power companies to connect with when you're ready to move to renewable energy. The Best Solar Installation & Services in Kelowna · Polaron Solar · Future West Solar · SkyFire Energy Inc. · Solos Energy · A · B · C · D. Install a solar power system for your home or business in Halifax, Moncton, Fredericton, Ottawa, Toronto, Winnipeg, Regina, Edmonton, Calgary. NRG Clean Power is the leading solar company in California We leverage over 30 years of experience as one of California's best solar companies to ensure you. Bigger projects present unique challenges. Westcoast Solar Energy is one of the top solar companies in Sonoma County with the experience to make sure every.

Referral Scheme

How to create an employee referral program · 1. Get management on board · 2. Create an easy referral process · 3. Set goals · 4. Offer a mix of incentives · 5. Referral program software tools make it really easy and intuitive to set up a referral program. Follow these steps to get started. Employee referral scheme · 1. By logging into Oracle R12 · 2. Through HR Shared Services (HRSS) live chat · 3. On your payslip · 4. Or call our HRSS team on. Earn 10% Commission Payments when you refer a friend or colleague to Pound Social's Social Media or Blog Plans! A referral program is a system where a brand identifies and reaches out to the people who like or love the brand and asks them to tell friends and family about. Get rewarded up to USD $2, (in CRO) for every friend you refer to the nasutki39.ru Exchange AND 50% of their trading fees! From Typeform, Uber, Paypal, Prezi to x, we reviewed 51 companies' referral programs and campaigns so you can see what's common, what's cutting edge, and what'. GrowSurf is referral program software that helps marketing, product, and engineering teams launch a customer referral program in days, not weeks. · Automate. We help you build the same waitlist, contest, affiliate, or referral program used to launch and scale Airbnb, Uber, PayPal, and s of other businesses. How to create an employee referral program · 1. Get management on board · 2. Create an easy referral process · 3. Set goals · 4. Offer a mix of incentives · 5. Referral program software tools make it really easy and intuitive to set up a referral program. Follow these steps to get started. Employee referral scheme · 1. By logging into Oracle R12 · 2. Through HR Shared Services (HRSS) live chat · 3. On your payslip · 4. Or call our HRSS team on. Earn 10% Commission Payments when you refer a friend or colleague to Pound Social's Social Media or Blog Plans! A referral program is a system where a brand identifies and reaches out to the people who like or love the brand and asks them to tell friends and family about. Get rewarded up to USD $2, (in CRO) for every friend you refer to the nasutki39.ru Exchange AND 50% of their trading fees! From Typeform, Uber, Paypal, Prezi to x, we reviewed 51 companies' referral programs and campaigns so you can see what's common, what's cutting edge, and what'. GrowSurf is referral program software that helps marketing, product, and engineering teams launch a customer referral program in days, not weeks. · Automate. We help you build the same waitlist, contest, affiliate, or referral program used to launch and scale Airbnb, Uber, PayPal, and s of other businesses.

Invite friends to Dropbox to earn more space for your account. If a friend signs up with the referral link in your invite, you'll earn free storage space. The Refer and Earn program gives both new and existing customers access to benefits when purchasing a qualifying Tesla product. An employee referral program is a recruiting strategy in which employers encourage current employees, through rewards, to refer qualified candidates for jobs. Share the Magenta experience with your friends and get a little reward for yourself for every friend you refer and becomes a T-Mobile customer. Employee referrals - and programs - are on the rise. In today's article, 7 employee referral programs examples to help you get inspired. How to build a customer referral program in 5 steps · 1. Leverage customer referral templates · 2. Set KPIs and goals · 3. Choose incentives and rewards · 4. Employees who recommend a new hire have a vested interest in onboarding and retaining that person, as many referral programs include a requirement that the. The External Referral Award Program offers a one-time referral payment to persons unaffiliated with Leonardo DRS Inc., to help Leonardo DRS attract, hire and. How to design a referral program · Ask. When do you ask the user to refer? Why do you refer? · Target. Which users do you target? All of them? · Incentive. A referral program is a word-of-mouth marketing strategy that compensates existing customers for recommending your business to their family, acquaintances. Ease of use – Try to make the use of your employee referral program as easy as possible for your people. Feedback – As always, keep your employees posted on the. Types of app referral campaigns. One-to-one referral program. This program type is sometimes referred to as a “friend-to-friend” referral since it. Your referral program checklist · A great headline · Clearly explained benefits for both parties participating in your referral program · Relevant text and eye-. How it works. When you refer someone to DigitalOcean using your unique referral link, they'll receive a $, day credit as soon as they add a valid payment. A referral program is where a company rewards you for recommending their product or service to others. The reward can come in the form of a fixed sum credited. How to design a referral program · Ask. When do you ask the user to refer? Why do you refer? · Target. Which users do you target? All of them? · Incentive. In this article, we'll show you how to create a referral program, following six practical tips and real-world referral program examples. An employee referral program is organized and structured program employers use to ask existing employees to recommend candidates for open positions. Unlike. Make sure that the Referral Program Page URL does not include any redirections, as they will prevent the referred friend from getting their reward. If you must. Referral Program · SHARE YOUR UNIQUE LINK WITH YOUR FRIENDS. Your Referral Code is unique. · THEY WILL BE GRANTED 5, UEC. New recruits can sign up to Star.

What To Do With Your Retirement Money

You can try to increase your income, reduce your expenses, or perform some combination of the two if you find that your retirement income isn't adequate to. When you make withdrawals from your accounts in a certain order, you can minimize taxes on what you take out and leave the remaining funds invested so they have. A retirement income plan can help you define your withdrawal strategy—or when and how often you will pull money from your retirement investment accounts. IRAs. Find how to make tax-deferred investments for your retirement by contributing to traditional and Roth IRAs. Get started. You are limited to moving your assets to those the (k) offers if you want to keep it in the (k). You can roll it over into an IRA tax free. Learn how to make your retirement savings work harder with our five value drivers, helping you achieve a worry-free retirement. You can combine your retirement plan savings with other sources of retirement income, such as Social Security or a pension, to create a long-lasting stream of. Make two lists: expenses and income sources. First, sit down with your spouse or partner — if you have one — and your financial advisor and calculate. Dedicate at least half of the new money to your retirement plan account. And while it may be tempting to take that tax refund or salary bonus and splurge on a. You can try to increase your income, reduce your expenses, or perform some combination of the two if you find that your retirement income isn't adequate to. When you make withdrawals from your accounts in a certain order, you can minimize taxes on what you take out and leave the remaining funds invested so they have. A retirement income plan can help you define your withdrawal strategy—or when and how often you will pull money from your retirement investment accounts. IRAs. Find how to make tax-deferred investments for your retirement by contributing to traditional and Roth IRAs. Get started. You are limited to moving your assets to those the (k) offers if you want to keep it in the (k). You can roll it over into an IRA tax free. Learn how to make your retirement savings work harder with our five value drivers, helping you achieve a worry-free retirement. You can combine your retirement plan savings with other sources of retirement income, such as Social Security or a pension, to create a long-lasting stream of. Make two lists: expenses and income sources. First, sit down with your spouse or partner — if you have one — and your financial advisor and calculate. Dedicate at least half of the new money to your retirement plan account. And while it may be tempting to take that tax refund or salary bonus and splurge on a.

Don't cash out your retirement savings upon losing your job. Instead, roll it over into an IRA or a new employer's retirement savings plan to continue. Here are some suggestions to follow as you explore all that retirement has to offer. Make sure your spending rate is sustainable. Upon retirement, you have the option to leave your money in your (k), transfer it to an IRA, withdraw a lump sum, convert it into an annuity, or take. 4 options for an old (k): Keep it with your old employer's plan, roll over the money into an IRA, roll over into a new employer's plan (including plans. The sooner you start saving, the more time your money has to grow (see the chart below). Make saving for retirement a priority. Devise a plan, stick to it, and. The sooner you start saving, the more time your money has to grow (see the chart below). Make saving for retirement a priority. Devise a plan, stick to it, and. When You Leave a Job, What Happens to Your Retirement Savings? · Roll Over to an IRA. Roll the balance into an individual retirement account (IRA). · Roll Over. 1. Take responsibility for your retirement · 2. Start to protect your income by using a diversified retirement plan · 3. Create lifetime income with the potential. Saving for retirement might be the most important thing you ever do with your money. And the earlier you begin, the less money it will take! 4 minute read. Upon retirement, you have the option to leave your money in your (k), transfer it to an IRA, withdraw a lump sum, convert it into an annuity, or take. Annuities, which can generate a guaranteed stream of income for a period of years or until your death or the death of you and a joint recipient such as a spouse. Rolling over your old (k) into your new company's plan can also make it easier to track your retirement savings, since you'll have everything in one place. Leaving your money in a tax-advantaged retirement account preserves the tax benefits and can help with tax-deferred growth potential over time. Steps to take. Many employers will offer to match your retirement plan contributions, so contribute at least enough to take full advantage of that—it's basically free money. The process of creating a retirement plan includes identifying your income sources, adding up your expenses, putting a savings plan into effect, and managing. The employee also may take the balance out of the plan, but will owe taxes and possibly penalties, thus reducing retirement income. Plans may cash out small. If you're at least 62 and live on a fixed income, you might also get retirement income from a reverse mortgage. Officially called home equity conversion. Potential retirement income sources include Social Security, pensions, annuities, retirement savings from a qualified employer sponsored plan (QRP) like (k). Consolidating your retirement accounts by rolling your savings into a single IRA can simplify your financial life. If you plan to take on another job in. Hold the money in a relatively safe, liquid account, such as an interest-bearing bank account or money market fund. Two to four years' worth of living expenses.

Tax Percentage On Ira Withdrawal

IRA stands for Individual Retirement Account. It's basically a savings account with big tax breaks, making it an ideal way to sock away cash for your. Illinois does not tax the amount of any federally taxed portion (not the gross amount) included in your Form IL, Line 1, that you received from. With a traditional IRA, withdrawals are taxed as regular income (not capital gains) based on your tax bracket in the year of the withdrawal. Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Tax Rates and Traditional vs. Roth IRAs. If tax. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account. Traditional IRA. When you withdraw from a traditional IRA before age 59½, you'll pay a 10% federal penalty tax as well as tax on the withdrawal. Traditional IRA, then pay taxes on the distributions during retire- ment – at impact your tax rates and income needs during retirement. Will Social. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. In most cases, IRA cash distributions are subject to a default 10% federal withholding rate. However, the 10% rate may not be suitable for your tax situation. IRA stands for Individual Retirement Account. It's basically a savings account with big tax breaks, making it an ideal way to sock away cash for your. Illinois does not tax the amount of any federally taxed portion (not the gross amount) included in your Form IL, Line 1, that you received from. With a traditional IRA, withdrawals are taxed as regular income (not capital gains) based on your tax bracket in the year of the withdrawal. Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Tax Rates and Traditional vs. Roth IRAs. If tax. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account. Traditional IRA. When you withdraw from a traditional IRA before age 59½, you'll pay a 10% federal penalty tax as well as tax on the withdrawal. Traditional IRA, then pay taxes on the distributions during retire- ment – at impact your tax rates and income needs during retirement. Will Social. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. In most cases, IRA cash distributions are subject to a default 10% federal withholding rate. However, the 10% rate may not be suitable for your tax situation.

Roth IRA or Roth (k) qualified distributions are tax-free. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the. Early withdrawals face a 10% penalty plus your income tax rate. Are taxes automatically taken out of a (k) withdrawal? Yes, 20% federal tax is usually. But, keep in mind that no matter your employment status or your age, the money you withdraw will be taxed as ordinary income, says the IRS. And, if you're under. How are RMDs taxed? If all your IRA contributions were tax-deductible when you made them, the full amount of the RMD will be treated as ordinary income for. IRA distributions are generally included in the recipient's gross income and taxed as ordinary income, other than qualified distributions from a Roth IRA. When you withdraw the money, both the initial investment and the gains it earned are taxed at your income tax rate when withdrawn. However, if you withdraw. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. There are. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. Basically, any amount you withdraw from your (k) account has taxes withheld at 20%, and if you're under age 59½, you'll be taxed an additional 10% when you. Payments from the Roth IRA that are not qualified distributions will be taxed to the extent of earnings after the rollover, including the 10% additional income. Early Withdrawal Penalties for Traditional IRAs. There is a 10% additional tax on early withdrawals from your traditional IRA. You can receive distributions. Regardless of whether you elect a withholding percentage for your IRA withdrawal, you are responsible for all federal, state, and local taxes, as well as. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Tax will be withheld on a 10% rate for non-periodic distributions. New York State and New York City Tax Exemption: Withdrawals from the NYCE IRA are. All withdrawals are % taxable, and you must include them in your taxable income for the year you take them. Subsequent distributions from your Roth IRA or Roth eligible employer account may be taxed and subject to the 10% early withdrawal penalty (see page 3) if that. IRS regulations require us to withhold federal income tax at the rate of 10 distribution(s) (excluding Roth IRA distributions) at a rate of If you can qualify for one of them, you might be able to take IRA withdrawals at a modest tax rate, at any age. One such exception covers withdrawals for higher. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income.

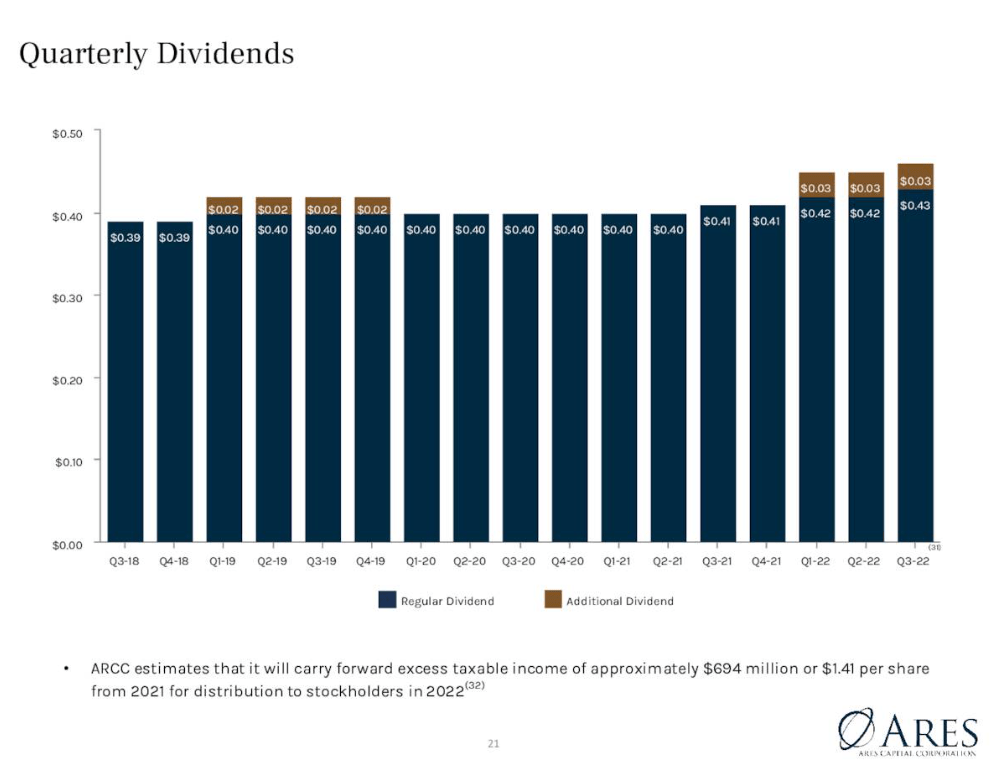

Ares Capital Stock Forecast

According to the research reports of 8 Wall Street equities research analysts, the average twelve-month stock price forecast for Ares Capital is $, with a. Find the latest Ares Capital Corporation (ARCC) stock forecast, month price target, predictions and analyst recommendations. According to analysts, ARCC price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. View the ARCC premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Ares Capital. Key Stock Data · P/E Ratio (TTM). (08/22/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. Ares Capital Corp. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - The Ares Capital stock forecast for tomorrow is $ , which would represent a % loss compared to the current price. In the next week, the price of ARCC. The average one-year price target for Ares Capital Corporation is $ The forecasts range from a low of $ to a high of $ A stock's price. The 8 analysts with month price forecasts for Ares Capital stock have an average target of , with a low estimate of 20 and a high estimate of The. According to the research reports of 8 Wall Street equities research analysts, the average twelve-month stock price forecast for Ares Capital is $, with a. Find the latest Ares Capital Corporation (ARCC) stock forecast, month price target, predictions and analyst recommendations. According to analysts, ARCC price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. View the ARCC premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Ares Capital. Key Stock Data · P/E Ratio (TTM). (08/22/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. Ares Capital Corp. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - The Ares Capital stock forecast for tomorrow is $ , which would represent a % loss compared to the current price. In the next week, the price of ARCC. The average one-year price target for Ares Capital Corporation is $ The forecasts range from a low of $ to a high of $ A stock's price. The 8 analysts with month price forecasts for Ares Capital stock have an average target of , with a low estimate of 20 and a high estimate of The.

Ares Capital (ARCC) stock price prediction is USD. The Ares Capital stock forecast is USD for August 29, Friday;. Ares Capital Corporation is a business development company specializing in acquisition, recapitalization, mezzanine debt, restructurings, rescue financing, and. Zacks' proprietary data indicates that Ares Capital Corporation is currently rated as a Zacks Rank 3 and we are expecting an inline return from the ARCC shares. Ares Capital Stock Buy Hold or Sell Recommendation Stocks. USA. Given the investment horizon of 90 days and your above-average risk tolerance, our. View Ares Capital Corporation ARCC stock quote prices, financial information, real-time forecasts, and company news from CNN. Ares Capital's market cap is calculated by multiplying ARCC's current stock price of $ by ARCC's total outstanding shares of ,, Get the latest Ares Capital Corporation (ARCC) real-time quote, historical performance, charts, and other financial information to help you make more. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Ares Capital Stock Forecast · Over the next 52 weeks, Ares Capital has on average historically risen by % based on the past 19 years of stock performance. Ares Capital Stock Forecast, ARCC stock price prediction. Price target in 14 days: USD. The best long-term & short-term Ares Capital share price. The average price target is $ with a high estimate of $23 and a low estimate of $ Sign in to your SmartPortfolio to see more analyst recommendations. Ares Capital Corp. analyst estimates, including ARCC earnings per share Stock Price Targets. High, $ Median, $ Low, $ Average, $ The current price of ARCC is USD — it has increased by % in the past 24 hours. Watch Ares Capital Corporation stock price performance more closely on. Get Ares Capital Corp (ARCC:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. While ratings are subjective and will change, the latest Ares Capital (ARCC) rating was a reiterated with a price target of $ to $ The current price. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ ARCC will report FY earnings on 02/05/ Yearly Estimates. Over the last 12 months, its price rose by percent. Looking ahead, we forecast Ares Capital to be priced at by the end of this quarter and at Analyst Rating and Forecast Ares Capital Corp is a United States-based closed-ended specialty finance company. Its investment ob Show More. On average, Wall Street analysts predict that Ares Capital's share price could reach $ by Aug 5, The average Ares Capital stock price prediction. Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is.

Syndication For Real Estate

Real Estate Syndication Basics. Real estate syndication is a transaction between a Sponsor and a group of Investors. As the manager and operator of the deal. A real estate syndication is where a group of individuals or companies pool their money together to purchase a property and benefit from the rental income. Real estate syndications work by pooling together capital from multiple investors to acquire and manage a real estate property (or portfolio). Let's take a. Real estate syndications are groups of real estate investors who put their money together to develop a property. A real estate syndication is a process by which a group of investors pool their money together to buy a property or properties. The group is typically made up. A real estate syndication is where a group of people pool their resources to purchase real estate – often a large property like an apartment building. Real estate syndication is a form of crowdfunding for the purpose of investing in residential or commercial real estate. It involves pooling capital with other. Explore real estate syndication: navigate investment horizons, understand tax implications, and more with our comprehensive FAQ guide. Real estate syndication is a way for investors to pool their financial and intellectual resources to invest in bigger properties and projects. Real Estate Syndication Basics. Real estate syndication is a transaction between a Sponsor and a group of Investors. As the manager and operator of the deal. A real estate syndication is where a group of individuals or companies pool their money together to purchase a property and benefit from the rental income. Real estate syndications work by pooling together capital from multiple investors to acquire and manage a real estate property (or portfolio). Let's take a. Real estate syndications are groups of real estate investors who put their money together to develop a property. A real estate syndication is a process by which a group of investors pool their money together to buy a property or properties. The group is typically made up. A real estate syndication is where a group of people pool their resources to purchase real estate – often a large property like an apartment building. Real estate syndication is a form of crowdfunding for the purpose of investing in residential or commercial real estate. It involves pooling capital with other. Explore real estate syndication: navigate investment horizons, understand tax implications, and more with our comprehensive FAQ guide. Real estate syndication is a way for investors to pool their financial and intellectual resources to invest in bigger properties and projects.

Real estate syndication is an investment strategy where a group of investors collectively park in real estate properties by pooling their resources, knowledge. We offer a primer on the basics of syndications: how to invest, what you can expect, terminology to know, and concepts involved in vetting deals. Real estate syndication involves a group of investors pooling their resources to collectively invest in larger-scale real estate projects that would otherwise. A syndication is the pooling of capital and resources among multiple investors to achieve a common goal, specifically investing in properties. Real estate syndications are a great way to diversify your portfolio, get exposure to multiple asset classes and markets, and potentially earn higher returns. Multifamily real estate syndication investments are very attractive options for investors who want to increase their net worth while building a diversified. This ultimate guide to real estate syndication will help you unlock the potential of this potentially profitable investment opportunity. Syndicators typically earn between 20% and 50% of the distributable cash generated from operations, refinance or sale of a property, which may be paid as a. A real estate syndication is created when investors pool their capital to purchase a real estate asset, typically a single property. A wide range of real estate. Real Estate Syndication: A Doctor's Guide To Investing · 1) Have an income of at least $, each year for the last two years, or · 2) If you're married. A syndicate is a way for multiple investors to pool their money into an entity to purchase real estate. Real estate syndication is the process in which multiple investors pool their money together to purchase a commercial property. Real estate syndication is an effective way for investors to pool their capital and invest in opportunities that are much bigger than the opportunities those. When multifamily syndications focus on inexpensive homes in need of refurbishment, they may be extremely profitable. When the rent is increased, as well as when. Real estate syndications protect investor capital by investing in assets that are outside the stock market. They tend to operate on a “preferred return” basis. Real estate syndication is a method of pooling capital from multiple investors for the common goal of acquiring real estate. Learn more here. A syndicator of real estate will receive compensation for finding the deal, doing the due dilligence, and even structuring the deal. These fees can range. What is Syndication? Real estate syndication is a partnership where multiple investors combine their financial resources to invest in larger properties or. This article will tell you what you need to know about syndication, its legal form, dealing with investors, and how it differs from another popular form of. A real estate syndication is an investment vehicle in which a group of investors become direct or indirect owners in a one or multiple properties. Often these.

How Much Is A 401k Taxed

Withdrawals from a (k) plan may result in several types of tax, and you need to understand all of them. Distributions from qualified deferred compensation plans governed by the Employee Retirement Income Securities Act (ERISA) including a (k), (b), and. Basically, any amount you withdraw from your (k) account has taxes withheld at 20%, and if you're under age 59½, you'll be taxed an additional 10% when you. qualified employee benefit plans, including (K) plans;; an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that. This puts you in the 22% tax bracket. You can get a quick and dirty estimate of how much you could potentially save by multiplying your (k) contributions by. Taxes on IRAs and (k)s Once you start taking out income from a traditional IRA, you owe tax on the earnings portion of those withdrawals at your regular. When you take (k) distributions, the service provider withholds 20% of the income for federal income tax.8 If you effectively only owe 15% at tax time you'll. If you're under 59½, you may get hit with both ordinary income taxes and an additional 10% federal income tax. What's more, you could miss out on years of. You can choose to have your (k) plan transfer a distribution directly to another eligible plan or to an IRA. Under this option, no taxes are withheld. If you. Withdrawals from a (k) plan may result in several types of tax, and you need to understand all of them. Distributions from qualified deferred compensation plans governed by the Employee Retirement Income Securities Act (ERISA) including a (k), (b), and. Basically, any amount you withdraw from your (k) account has taxes withheld at 20%, and if you're under age 59½, you'll be taxed an additional 10% when you. qualified employee benefit plans, including (K) plans;; an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that. This puts you in the 22% tax bracket. You can get a quick and dirty estimate of how much you could potentially save by multiplying your (k) contributions by. Taxes on IRAs and (k)s Once you start taking out income from a traditional IRA, you owe tax on the earnings portion of those withdrawals at your regular. When you take (k) distributions, the service provider withholds 20% of the income for federal income tax.8 If you effectively only owe 15% at tax time you'll. If you're under 59½, you may get hit with both ordinary income taxes and an additional 10% federal income tax. What's more, you could miss out on years of. You can choose to have your (k) plan transfer a distribution directly to another eligible plan or to an IRA. Under this option, no taxes are withheld. If you.

"A Roth IRA or Roth (k) can help you save on taxes in retirement. Not only are withdrawals potentially tax-free,2 they won't impact the taxation of your. However, the IRS will still deduct FICA taxes (Medicare and Social Security taxes) on your gross income (inclusive of your (k) contributions). Tax Treatment. Taxes on a Traditional (k) They pay $6, in federal taxes. That's (10% x $23,) + [12% x ($60,$23,)], due to how effective tax rates work. If. But, no, you don't pay income tax twice on (k) withdrawals. With the 20% withholding on your distribution, you're essentially paying part of your taxes. This puts you in the 22% tax bracket. You can get a quick and dirty estimate of how much you could potentially save by multiplying your (k) contributions by. When you take (k) distributions, the service provider withholds 20% of the income for federal income tax.8 If you effectively only owe 15% at tax time you'll. Investors pulling from their taxable accounts will owe capital gains taxes, whereas money coming out of a traditional (k) is taxed at the investor's ordinary. The 20% tax withholding for a (k) early withdrawal. The income tax due on an early (k) distribution. Missed investment growth. How to minimize the cost of. However, the IRS will still deduct FICA taxes (Medicare and Social Security taxes) on your gross income (inclusive of your (k) contributions). Tax Treatment. Contributions to a traditional (k) are made pre-tax, so while it reduces your taxable income in the year you contribute to it, you have to pay taxes on the. *Distributions from your QRP are taxed as ordinary income and may be subject to an IRS 10% additional tax if taken prior to age 59 1/2. You avoid the IRS 10%. You may also have to pay an additional 10% tax, unless you're age 59½ or older or qualify for another exception. You may not be able to contribute to your. For traditional plans you will owe income tax on all your withdrawals - both the money you contributed and the gains on your contributions. Remember: Money you. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. However, when you take an early withdrawal from a (k), you could lose a significant portion of your retirement money right from the start. Income taxes, a You already know about the benefits of saving in your workplace savings plan, like a (k). But you may be able to save more than you think—for many people. This includes most sources of retirement income, including: Pensions; (k), (b), and similar investments; Tier 2 Railroad Retirement; Traditional IRAs. (k) Plans Figuring out how much tax to withhold from a pension payment can be challenging. If your k contributions were traditional personal deferrals the answer is yes you will pay income tax on your withdrawals. If you take withdrawals before. As a resident of Delaware, the amount of your pension and K income that is taxable for federal purposes is also taxable in Delaware. However, person's

Trading Simulator Replay

Replay Training, Weekly Simulator, Practice, Pre-market prepare, Hints replay, TradingTerminal Replay, TradingTerminal Simulator, Moderators, Watchlist. Chart Master is a trading simulator/game that allows you to practice your trading skills using historical chart data. THE BEST PART? ATAS Market Replay allows you to trade on historical charts as if it was in real time, but you do nor risk losing your money. The world's most realistic market replay simulator. Equities, Crypto, Futures. Level 2, Market Scanning, Design your own experience. FREE 7 day trial. On Demand Market Replay powered by Tradovate allows you to replay periods in the market The following is a mandatory disclaimer for SIM Trading results. The Best Stock Market Replay Simulator · Train, Backtest, and trade on demand How Can A Trading Sim Help Your Trading? trading-sim-features. Not Sure. We have narrowed our picks for the best stock trading simulators to only a handful that allow realistic market replay, on demand. Trade Now. Practice Trading in the stock market. And learn the essentials. Scroll Down. NO COMMITMENT, NO RISK, NO MONEY INVOLVED. Trading Simulator. Trading is. FX Replay is the best backtesting software with the best charting platform in the market TradingView. Get the BEST backtesting experience % online. Replay Training, Weekly Simulator, Practice, Pre-market prepare, Hints replay, TradingTerminal Replay, TradingTerminal Simulator, Moderators, Watchlist. Chart Master is a trading simulator/game that allows you to practice your trading skills using historical chart data. THE BEST PART? ATAS Market Replay allows you to trade on historical charts as if it was in real time, but you do nor risk losing your money. The world's most realistic market replay simulator. Equities, Crypto, Futures. Level 2, Market Scanning, Design your own experience. FREE 7 day trial. On Demand Market Replay powered by Tradovate allows you to replay periods in the market The following is a mandatory disclaimer for SIM Trading results. The Best Stock Market Replay Simulator · Train, Backtest, and trade on demand How Can A Trading Sim Help Your Trading? trading-sim-features. Not Sure. We have narrowed our picks for the best stock trading simulators to only a handful that allow realistic market replay, on demand. Trade Now. Practice Trading in the stock market. And learn the essentials. Scroll Down. NO COMMITMENT, NO RISK, NO MONEY INVOLVED. Trading Simulator. Trading is. FX Replay is the best backtesting software with the best charting platform in the market TradingView. Get the BEST backtesting experience % online.

DupliTrade has specifically developed the leading simulator trading platform, which was invented by traders for traders. It was identified that there was a gap. The Market Replay feature allows you to metaphorically travel back in time to refine your manual trading skills on historical market data. Try our futures and options trading simulator. Our simulated trading accounts don't just give you access to trade stocks. You can try your hand at various. Replay simulators actually replay the historical market data at your convenience to simulate placing you selected periods in time. It's like using a time. TradingView market replay works really well. Can replay a stock on any timeframe with the SPY and any other indicator you want also visible. . In both full screen and standard chart modes, you can tap "Replay" after tapping the chart square icon on the lower right corner of the navigation. Market Replay. You can record market data on the charts and then play it back later in simulated trading mode to review the day's action and try different. trading simulator. Unlimited trade simulation included with all accounts Replay FREE historical market data tick by tick, fully synchronized across. Learn about strock trading in a fun and interactive way with Alpha Chart's Trading Simulator. - Chart game Replay. If you choose to purchase Premium Plan. Nasdaq Market Replay is a cloud-based replay and analysis tool, allowing users to view the consolidated order book and trade data for Nasdaq-, NYSE- and other. Market replay simulators can speed up a trader's learning curves by studying and replaying past trades, learning new setups, and improving their trading skills. FOREX SIMULATOR that really --> WORKS Replay markets with real history data. Free Web-based BACKTESTING | Trading Strategy Validator. Replay provides traders with a comprehensive toolset for analyzing and improving your trading strategies. With advanced charting and replay features. You will have the ability to trade US equities markets in real-time and later at home with “Replay Feature”. New traders gain experience without risk, and can. Advanced trading simulator, fx replay trading and Backtesting with live Analitycs | Web-App for strategy development. Try our stocks & futures day trading simulator & become a consistently profitable trader today A lightning-fast replay of the ENTIRE market for you to. Access futures markets, 40+ advanced trading tools and real-time market data with a Tradovate SIM subscription ✓ Market Replay (additional fee applies). Ad-. Learn trading quickly with Forex Simulator. Improve Forex Simulator lets you move back in time and replay the market starting from any selected day. In the Bar Replay mode, trading on historical data is available. This is a separate trading mode from Paper Trading. Data on trades and the overall result. Tired of manually screen-recording your trades? Analyse your trades with TradeZella's new Trade Replay feature. Go back in time to replay a trade in your.

Mizuho News

Mizuho agrees $mn deal for boutique investment bank Greenhill. Japanese group is paying significant premium as it seeks to quicken US expansion. Get all latest & breaking news on Mizuho Bank. Watch videos, top stories and articles on Mizuho Bank at nasutki39.ru News · Mizuho to partially restructure in-house companies · Changes of Directors and Executive Officers · Mizuho Financial Group and Lombard Odier form. Mizuho Financial Group, Inc. - ADR is listed as: · Earnings Gainer in category · Safe(er) Stock in category. See all. Mizuho Financial Group related ESG news, ESG data, sustainability report, climate impact, ESG Ratings & Scores from MSCI, Sustainalytics & Refinitiv. Get Mizuho Financial Group Inc (T-JP:Tokyo Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Japan's third-largest lender by assets, Mizuho Financial Group, reported an 18% growth in first-quarter profit on Wednesday. Mizuho invests $m into Credit Saison India. CS India has million active loans and assets under management of $b. News · “Mizuho is hiring for the next generation on the trading floor.” · Mizuho hires Paul Stephens as Chief Information Officer, EMEA · "We have the products. Mizuho agrees $mn deal for boutique investment bank Greenhill. Japanese group is paying significant premium as it seeks to quicken US expansion. Get all latest & breaking news on Mizuho Bank. Watch videos, top stories and articles on Mizuho Bank at nasutki39.ru News · Mizuho to partially restructure in-house companies · Changes of Directors and Executive Officers · Mizuho Financial Group and Lombard Odier form. Mizuho Financial Group, Inc. - ADR is listed as: · Earnings Gainer in category · Safe(er) Stock in category. See all. Mizuho Financial Group related ESG news, ESG data, sustainability report, climate impact, ESG Ratings & Scores from MSCI, Sustainalytics & Refinitiv. Get Mizuho Financial Group Inc (T-JP:Tokyo Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Japan's third-largest lender by assets, Mizuho Financial Group, reported an 18% growth in first-quarter profit on Wednesday. Mizuho invests $m into Credit Saison India. CS India has million active loans and assets under management of $b. News · “Mizuho is hiring for the next generation on the trading floor.” · Mizuho hires Paul Stephens as Chief Information Officer, EMEA · "We have the products.

Read the latest news and coverage on Mizuho. Finextra brings you articles, videos and more on Mizuho. Mizuho Information & Research Institute, Murata Manufacturing and The Elegant Monkeys signed a MoU to provide an innovative emotions AI solution to the Japanese. Asian Banking & Finance - Mizuho Financial Group - Latest Mizuho Financial Group Group News, Analysis, Profit Results, Share Price, Information. THE BUSINESS TIMES Mizuho Financial Corp - Find Mizuho Financial Corp News & Headlines, insight and analysis in Singapore, Asia-Pacific & global markets. Mizuho Financial Group announces intention to create Universal Bank in the EU region, to bring together Banking and Securities businesses. An active player in the Indian financial services space, Mizuho has already infused about $ million (₹4, crore) into its India bank br. Discover real-time Mizuho Financial Group, Inc. Sponosred ADR (Japan) (MFG) stock prices, quotes, historical data, news, and Insights for informed trading. The latest news, analysis and opinion on Mizuho Financial Group Inc. In-depth analysis, industry insights and expert opinion. Get the latest Mizuho Financial Group Inc (MFG) real-time quote, historical performance, charts, and other financial information to help you make more. Mizuho OSI Receives Award for Performance Excellence; Silver Recognition by California Council for Excellence. Mizuho OSI has been recognized by The. Mizuho Financial Group · Mizuho profit rises unexpectedly on higher lending income · Mizuho Bank launches foundation to drive philanthropic efforts · Mizuho. Mizuho Bank, Ltd. -- Moody's announces completion of a periodic review of ratings of Mizuho Financial Group, Inc. The latest international Mizuho Financial Group Inc news and views from Reuters - one of the world's largest news agencies. MIZUHO BANK UltraTech Cement raised $ million through a sustainability-linked loan, marking its second such endeavour after a bond issuance. Six. “We want to be squarely positioned as a top 10 investment banking platform in the US,” Katz told Financial News. Mizuho's ambitions for its investment bank come. Get the latest Mizuho Financial Group, Inc. (MFG) stock news and headlines to help you in your trading and investing decisions. Latest Mizuho Financial Group articles on risk management, derivatives and complex finance. Mizuho, Abu Dhabi Commercial Bank, Riyad Capital──the investment arm of Saudi Arabia's Riyad Bank──and Dubai-based trading firms Tharwa Capital and Al Mal. Mizuho Financial Group, Inc. operates as a holding company which engages in the provision of financial services such as banking, trust banking, securities. Mizuho Financial Group is a bank holding company that manages and engages in ancillary operations.